invoice no: นี่คือโพสต์ที่เกี่ยวข้องกับหัวข้อนี้

When it comes to assigning invoice numbers, life can seem like it is not all that straightforward. This is particularly true if you have multiple clients: do you have a separate invoice numbering system for each client?

Our tips on how to assign invoice numbers will make your life so much easier in terms of keeping track of all of your invoices, no matter how small or large your business. Moreover, if you have a tax audit, proper invoicing is a must: so check out our advice to ensure that you stay above board.

What is an invoice number?

An invoice number is a unique number that is assigned to each invoice. This number is one of the most important elements of every invoice. Its role is to identify transactions, so it needs to be unique. Invoice number can contain only numbers or letters and numbers. It may contain date of issue, name of project or task.

zistemo Hint #1: If you want to be sure that your invoice will consist of all required elements – issue invoices for FREE with: FREE Invoice Generator

Best practices on numbering invoices

- Make every invoice number unique – you can start from any number you want

- Assign sequential invoice numbers

- Assign invoice numbers in chronological way

- Structure invoice numbers any way you want, you may: use only numbers 001, 002, 003 etc., include Customer Name CN001, CN002, etc. or even add Project Name or Number PN-CN-001, PN-CN-002

- Use Invoicing Software to support you in sequential numbering system

What invoice number should I start with?

You can structure your invoice number any way you want, you can start from number 1 or 100, but it is good to follow some rules and best practices to keep invoice numbers in order.

How to number invoices?

The simple solution to this is to just label all invoices sequentially, at least for the same tax year.

- So the first invoice you send out to whatever client, is invoice ‘1’.

- Then, the second invoice you send out, no matter if that is the same client or a different one, gets an invoice numbered ‘2’.

- That way, you never have invoices with duplicate numbers.

zistemo Hint #2: If you want to be sure your invoice numbers are assigned correctly, why not start issuing invoices with zistemo?

It’s more than Invoicing Software and it gives you fully customizable invoice numbering. So when you put an initial number 0001301 for instance – zistemo will automatically increment that number.

Invoice numbers templates

Here are some examples of invoice numbers.

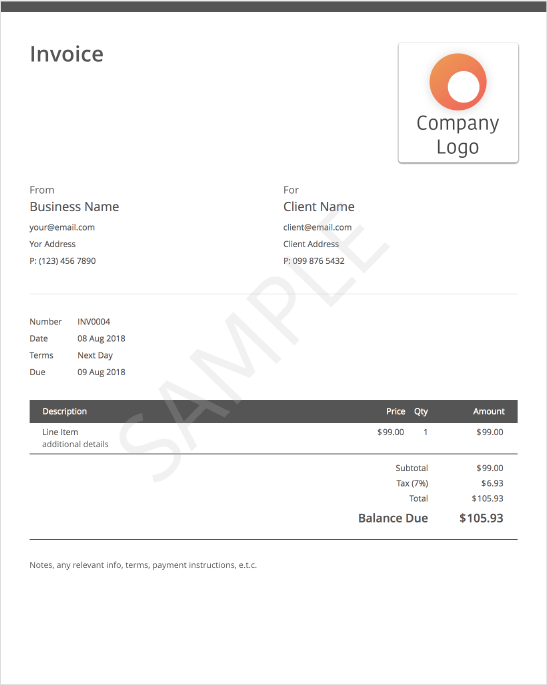

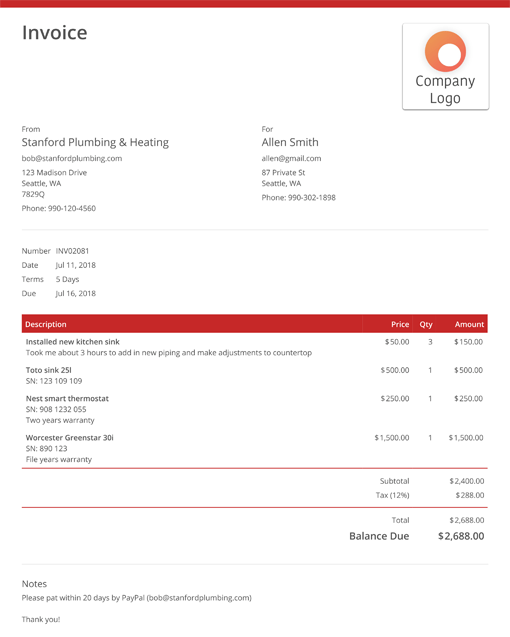

An invoice

In most simple words an invoice is a document issued by a seller to a buyer that specifies amount and costs of services or products provided by the seller. To know more check what is an invoice and how to create a good invoice to get paid faster.

Invoice Templates created with zistemo Invoice Software

zistemo will keep an eye on the numbers so you don’t get confused any more. With zistemo you will see at a glance:

- which invoices are paid and unpaid

- how old each invoice is: i.e. how long it has been since you issued the invoice to the client.

Does sequential invoice numbers simplify your life?

It can be tempting to have a separate invoice system for each client, or for each month. So, client 1 starts off with invoice numbered ‘1’, and client 2 starts with an invoice number ‘1’ as well. When a new month starts, you might be tempted to reset the numbers back to ‘1’.

You can see how this can get you into a muddle! Suddenly you have several invoices labelled ‘3’, but all for different clients, or for the same client but for different months. Even if you mark invoices with the client and the month, there is increased possibility for confusion. That’s way sequential invoice numbers make your life easier.

Want to number each project separately?

If you really want to, though, you can opt for a project related numbering system. With such a system, you use a separate invoicing sequence for every project that you are working on.

Each project may have multiple clients, though it is much more common for a single project to be allocated to a single client. With this system, the first invoice for project 1 is numbered ‘1’, and the numbers increase sequentially until the end of the project.

The first invoice for project 2 is also numbered ‘1’, and the numbers for this project also increase sequentially until the end of the project. And so on.

Seems a bit complicated? It might. But don’t worry zistemo is here to help.

zistemo Hint #3: zistemo masters the project related numbering and it supports Customer Level Invoice Sequence. The advantage of a project related numbering system is that it helps you to deal with each project as a self-contained unit.

Why not sign up for a FREE trial and see for yourself?

This is particularly good for medium sized or larger businesses, which perhaps have separate teams of employees working on each of several projects at a given time.

The project related numbering system nevertheless works on a basic sequential numbering model, so it also has the advantages of sequential numbering systems, as discussed above.

Are you in a risk to fail a tax audit?

We know for sure that:

-

- Different regulatory requirements in each country significantly increase the cost and complexity of tax compliance.

- Non-compliance to the country-specific electronic invoicing regulations increases business risks associated with a tax audit, and in some cases, fines.

As a result of these challenges, many companies choose to comply via paper invoices and manual processes and miss out on the huge opportunity for cost savings and streamlined processes that can be derived from e-invoicing.

If your accounts are audited, then incorrectly numbered invoices can look suspicious. Moreover, as suggested above, if you have several invoices with duplicate numbers, the margin for error is greatly increased.

This means that you are much more likely to make a mistake in your tax calculations, thinking that you have factored in a certain invoice when in fact you have not. This is another reason why sequential numbering of invoices makes your life easier all round.

zistemo Hint #4: “The advantage of a sequential numbering system is that it helps you to deal with each project as a self-contained unit and prevent from mistakes in tax calculation”.

How long do invoices need to be stored for?

Storing invoices for as long as possible is a good idea. Not only does it help you to keep track of how your business’s finances have developed over the years, it also gives you piece of mind.

-

-

Who knows when a client might query an invoice they paid several years ago?

-

-

Who knows when a client that you dealt with a decade ago might pop back up wanting to work with you again?

In these cases, it is a great idea to have their old invoices to hand to see how much they paid you, and also how promptly they paid. If old invoices show that certain clients took over a year to pay, for example, leaving you financially in the lurch, you might be wary of working with them again.

Each country that applies a tax to goods and services needs to manage its own unique regulatory requirements for electronic invoices – e.g. rules for electronic signatures, the number of years electronic invoices must be archived.

Storing Invoices tips from zistemo

-

-

As a guide, though, depending on the country you are trading in, invoices should really be kept from 3 to 10 financial years.

-

-

-

Throwing them away during this period is not advised.

-

-

For one thing, your finances could be audited, and you will need to show all of your invoices as proof that you calculated your taxes correctly.

A quick word of warning: even if records aren’t needed for tax reasons, you may need them for other reasons. Make sure that you check with your tax professional before tossing important records.

When it comes to storing your invoices, orderliness is key. Do not let them get strewn all over the office floor! A strong, locked box or a filing cabinet labeled ‘invoices’ is a good idea, for instance.

If you have numerous invoices, you can always input them into a digital database. Just make sure that you have someone checking each entry carefully, as there is additional margin for error when paper invoices are digitized by hand.

Having a computerized record of invoices also enables you to keep data on as many invoices as you like, without them taking up shelf in your filing cabinet.

zistemo Hint #5: “Number invoices sequentially and keep records of them for 3 to 10 financial years to ensure that everything is in order with your business. That way, you have nothing to fear from potential audits of your finances.”

With us, invoice numbering is painfree!

It’s never too late to organize your invoices. Start right now by joining zistemo for free and see how simple it all becomes.

[Update] Free Invoice Generator | invoice no – NATAVIGUIDES

Invoice Generator

How to make an invoice using the invoice generator

These step by step instructions will show you how to create an invoice that includes all the standard elements of a professional invoice. Below, we’ll dive into how you can customize your invoice to be unique to your business.

The first time you create an invoice, you’ll need to add some information to the blank invoice template.

-

Add your company details in the From section, including the name, phone number, and address

-

Fill out your client’s details in the For section, including name, email, and address

-

Add each line item, along with a description, rate, and quantity

-

If applicable, enter the tax rate, type of currency, and discount amount

-

Write payment instructions and terms in Notes section

-

Customize your invoice by adding a logo and selecting your brand color

How to send an invoice

Once your first invoice is complete, you’ll need to learn how to send it to your client. Our invoice generator gives you two easy options to send an invoice.

First, compose an email to your client. You can include a link to your invoice in the email or send them a PDF of the invoice as an attachment. The client simply clicks on the link or the attachment to see the invoice.

Then, check in on the status of your sent invoice. If you email your invoice directly from Invoice Simple, you will receive a notification when your customer views the invoice. The notification is useful for following up with clients to confirm payment.

Essential elements of an invoice

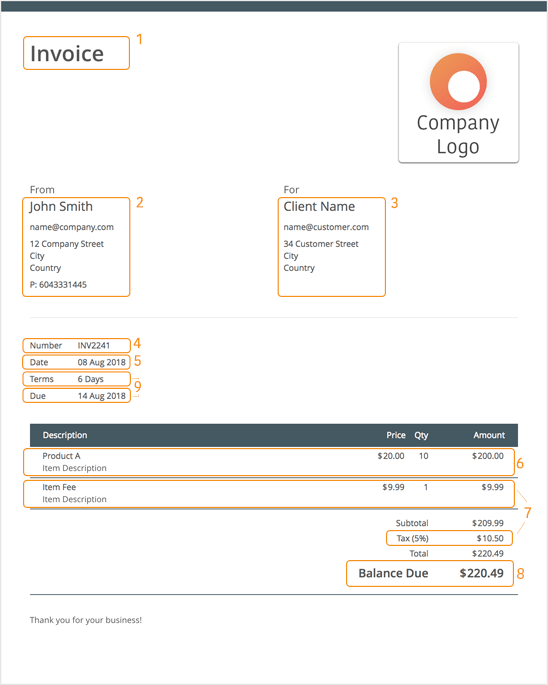

There are 9 main elements of an invoice. Some of theses elements are necessary, while others are extra or used only for customization.

-

Header

Headers should clearly state the purpose of a document. Our software allows you to generate estimates, invoices, and receipts. Including a header allows you and the client to tell them apart quickly. This will save you time when reviewing your records or completing taxes.

Note the image marked “Company Logo” to the right of the header. Here, you can add in your own logo for more professional estimates, invoices, and receipts. If your business does not have a logo, you can leave this section blank as long as the rest of the invoice is laid out properly.

-

Company name and details

When creating an invoice, you should include the legal name and contact details of your business. This should include your address, phone number, and email address. Usually, company information is written near the top of the invoice to create a clear differentiation between the company providing the goods or services and the company receiving them.

-

Name and Details of Client

Clearly state the name and contact details of your client. These contact details should include an address, phone number, and email address.

-

Invoice Number

Each invoice has a unique identifier called an invoice number. Invoice numbers can help keep track of multiple invoices. Invoice numbers can be formatted in various ways. These formats can include file numbers (INV0001), unique billing codes, or date-based purchase order numbers.

If you use Invoice Simple invoicing software to automatically manage your invoice number, the software will create a unique invoice number for each document. If you wish to use your own custom format for your invoice number, you can update each invoice number yourself each time you use the invoice generator.

-

Date

It’s important to include the date that each invoice is issued. This can clear up confusion when the same customer receives multiple invoices. Because payment is usually due a specified number of days after receipt of the invoice, including the date is an important part of showing when payment is due.

-

Description of Goods or Services Rendered

In box six, you should include separate line items for each good or service you are providing. Each row should include the following:

- Name of the goods or service provided.

- Unit price or hourly rate.

- Quantity or number of hours worked.

-

Itemized fees

Next, add any tax, shipping and handling, or extra fees that apply to the goods or services provided. We recommend listing these taxes and fees as separate line items, as some companies use different internal budgets to cover these fees.

-

Balance Due

The invoice generator will calculate the total balance due from the line items you entered in boxes six and seven.

-

Terms, Conditions and Payment Instructions

The terms and conditions of payment on an invoice is the part most frequently overlooked. The standard payment terms can vary by industry, your company’s policy, or previous history with the customer.

It’s important to clearly state the consequences of either party breaking this agreement. These penalties can include late fees or additional charges.

You can also add your preferred payment method here, whether it’s cheque, cash, bank transfer, Paypal, or credit card. Then, add in the payment instructions. For example, write your account number and bank name if clients are supposed to pay via a direct transfer.

Alternatives to Using an Invoice Generator

You may start out using a simple invoice template on Microsoft Excel or Word, but once you’ve made a few invoices you’ll realize that you’re wasting a lot of time on repetitive tasks. For example:

-

You need to duplicate and rename your original file every time you want to make a new Invoice.

-

You end up copying or re-typing client and item details despite sending the same client an invoice in the past.

-

It’s a hassle to organize and find old Invoices.

-

If you want to know how much you’ve invoiced over a certain period you’ll have to open up every single file and manually add up the totals.

Each extra minute you spend doing this administrative work is time and money lost.

Benefits of Using an Invoice Generator

Saving you from retyping information

The first time you use the Invoice Simple invoice generator, you’ll see a blank invoice template.<br/><br/>The next time you create an invoice, the invoice template will automatically fill in all of your relevant business information, items, and client information. The invoice generator will even use predictive text to autofill client information such as phone number, email address, and mailing address as you type the client’s name.

The next time you want to create an invoice, the invoice template will automatically be filled with all of your relevant information. The same applies to your clients and items. We’ll fill out your entire client information (phone, email, address) as you start typing the client name.

Get Shareable and Printable Online Invoice In One Go

You can share or download a PDF of your invoice with the click of a button. This saves a lot of time compared to Excel and Word invoice templates, for which you need to complete several steps to export a document as a PDF or be sure that your client can open files of a specific format.<br/><br/>There are other benefits to sending invoices through the Invoice Simple invoice generator, too.<ol><li>Your invoice will be suitable for mobile and desktop viewing.</li><li>You’ll be notified when your client receives and views the invoice.</li><li>If your client hasn’t viewed your invoice after a couple days, Invoice Simple will automatically send them a polite reminder.</li></ol>

Instead of working hard, we should work smart! The smart thing is to use the right tool for the job: an invoice generator.

There are a few additional benefits to emailing your invoice through Invoice Generator. One is that your invoice will be suitable for mobile and desktop viewing. Second is that you’ll be notified when your client receives and views the invoice. And thirdly if your client hasn’t viewed you invoice after a couple days, Invoice Simple will automatically send them a polite reminder.

Instead of working hard, we should work smart! The smart thing is to use the right tool for the job, an invoice generator.

Our Free Invoice Generator Saves You Time

When you use Invoice Simple’s invoice generator you save yourself a lot of time and effort. Here are some of the reasons why:

-

Automatically save your clients and items so they’re available the next time you’re writing an invoice

-

Organize your invoices in seconds

-

Use a professionally designed template that’s compatible with printers and mobile devices

-

See a full overview of your business effortlessly and in moments

-

Know when your invoice is viewed by a customer

-

Process credit cards online or on location

-

And access many more amazing benefits

See our guide to invoicing software for small businesses for more detail on all your options.

Online invoice generator Frequently Asked Questions

-

Q: Can I see a sample invoice?

A: You can easily preview what your invoice will look like by clicking on “preview” at the top left of the page. We’ve also put together a sample invoice for you, so you can see what a finished invoice would look like. Find more sample invoices here

-

Q: Can I put my own logo on the invoice template?

A: Yes. Select the logo box in the top right corner. Then, you can upload your logo or drag and drop it into place. Both JPEG and PNG images are supported.

-

Q: How do I send my Invoice?

A: The Invoice Simple invoice generator allows you to email your invoice, download a PDF copy, or send a link to your invoice. If you email your Invoice directly from Invoice Simple, we’ll notify you when your customer views it. This can be useful for following up with them later. If you send a link to your customer, they can download or print the invoice from the link.

-

Q: Will my clients see ‘Invoice Simple’ on my invoices?

A: Never. Regardless of whether you have a registered account or not, your generated invoices are always 100% unbranded.

-

Q: Can I generate a PDF invoice?

A: Absolutely. The PDF button at the top of the invoice page lets you instantly download a PDF file of your invoice that you can save for your records or send to your customer.

-

Q: Can I change the currency?

A: Yes. Our invoice generator should detect your currency automatically. However, if you want to make an invoice in a different currency, you can easily change the selected currency using the Settings panel on the right.

-

Q: Can I save my invoice and customer details?

A: Yes. Your invoices are automatically saved to your invoices list. There is also a clients list That automatically saves customer information.

-

Q: As a freelancer, how do I make an invoice for time?

A: We’ve found that what works well is to enter the number of hours worked into the quantity field and your hourly rate into the price field. The invoice generator will then calculate the total amount due.

-

Q: How do I charge taxes using the invoice generator?

A: If you’d like your invoice to include taxes on top of your prices, use the Settings panel on the right to enable a tax setting. Then, you can enter a tax rate and label.

-

Q: What about line items that already have tax applied?

A: If your prices already include tax, and you’d like your invoice to show the amount of tax included, then select the “Inclusive?” checkbox when enabling taxes.

-

Q: What is an invoice?

A: Looking to find out what an invoice really is? Here’s a complete explanation of what an invoice is . If that isn’t enough of an explanation, then see what Wikipedia has to say about it. Essentially, an invoice is a document that details what you did for a customer and what they owe you for that service or product.

-

Q: How can I process credit cards for my business?

A: We use payment processing services, Stripe and PayPal, depending on location. Simply sign up for Invoice Simple via our mobile apps or online, and go to the settings section to integrate payments.

-

Q: Can I create an invoice in another language?

A: Yes, you can easily generate an invoice in 5 languages:

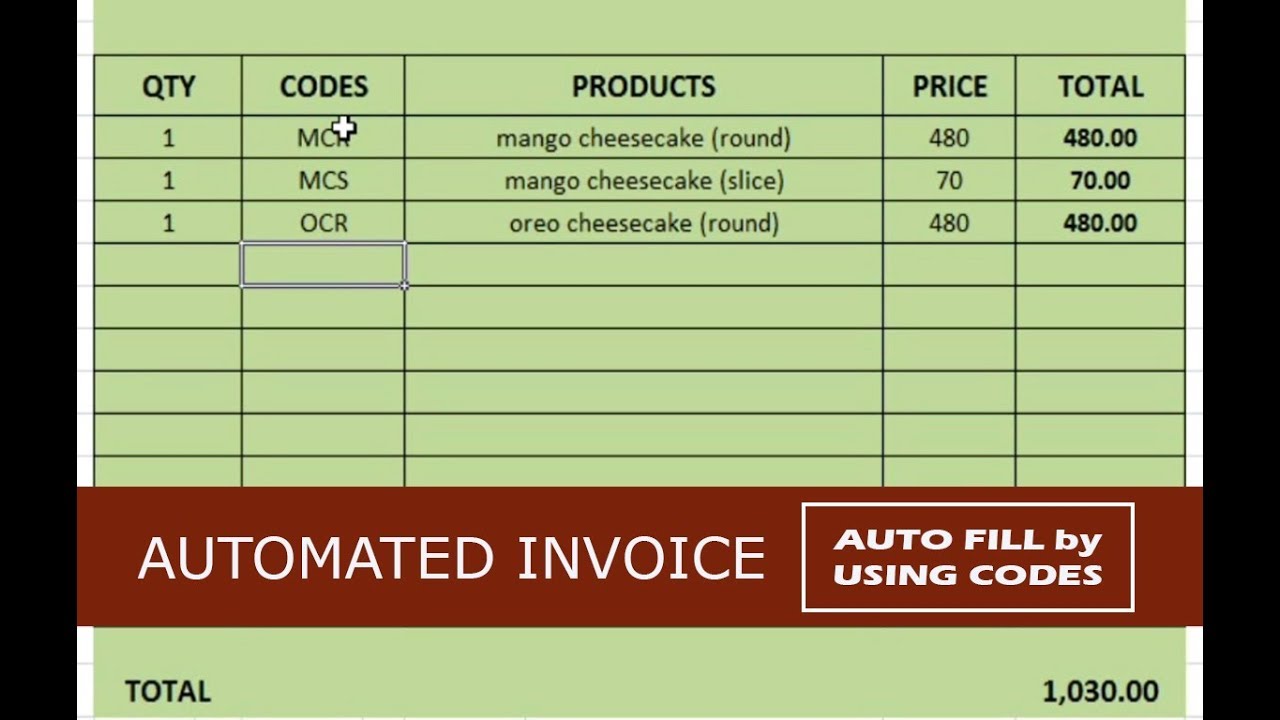

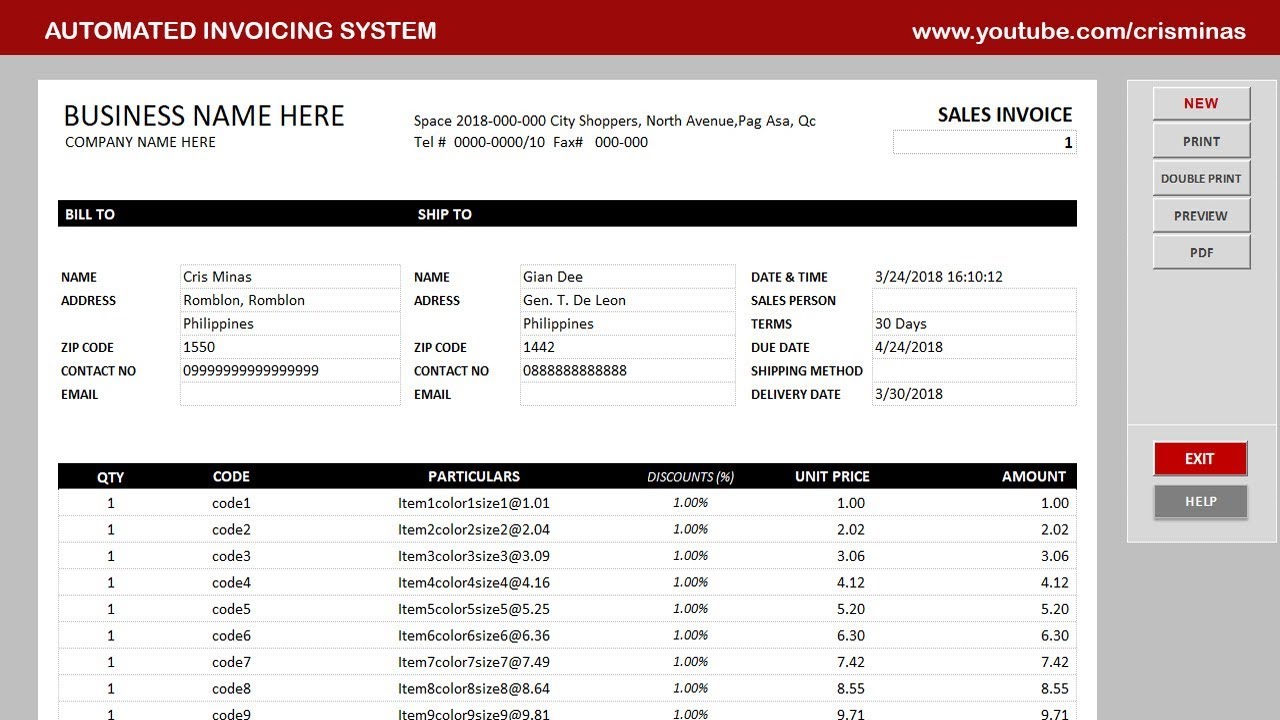

How to Create a Simple and Auto Fill Invoice in Excel

►How to Create a Simple and Automated Invoice in Excel w/ Drop List

https://youtu.be/35w9Djeco

►Automated Invoice System (FREE DOWNLOAD)

https://youtu.be/u6pCgBHhIs

►Automated Invoice System with Inventory (FREE DOWNLOAD)

https://youtu.be/E0TKlar1ZtA

นอกจากการดูบทความนี้แล้ว คุณยังสามารถดูข้อมูลที่เป็นประโยชน์อื่นๆ อีกมากมายที่เราให้ไว้ที่นี่: ดูเพิ่มเติม

Excel Automated Invoice Generator (FREE DOWNLOAD)

EXCEL INVOICE SYSTEM TEMPLATE

Note: The VBA of this template is not editable.

📌To save the invoice as PDF on your computer, create a new folder on your C: Drive and name it INVOICE.

Tutorial @ 7:43 of this video.

📌To add more items? Watch at 8:51.

📌FILE PASSWORD: crisminas

DOWNLOAD HERE:

EXCEL INVOICING SYSTEM TEMPLATE for Windows

https://drive.google.com/file/d/1vINqAiETf8fBpWij9e4ZWh1pNDSoODZK/view?usp=sharing

What is Invoice? | Types of Invoice | UP Board | Bijak Kya Hai | Important Questions

Hellow Fellow,

I’m @HRITHIK_KUMAR, In this video we learn about A topic of UP Board named Invoice(Bijak) And covered that types of Invoice, like electronic invoice, Debit Notes, Credit Notes, Debit invoice, Credit invoice, Loco invoice, Proforma invoice, and other most important topics are covered.

Important Books For Accountancy

Accountaning for Partnership firms and NPO: https://amzn.to/3go3nfG

Accountaning for Company: https://amzn.to/2CX6zR1

Financial Accountancy : https://amzn.to/2AuoVbm

Follow me on:

Facebook: https://www.facebook.com/hrithikumarz

Instagram: https://www.instagram.com/hrithikumarz

Twitter: https://twitter.com/hrithikumarz

Whatsapp Group Link: https://chat.whatsapp.com/BoVCVr08nG943i5voi7aYu

For More Search on google Type \”hrihtikumarz\”

Topics Covered:

What is Invoice,

Types of invoice,

Electronic Invoice,

Debit Notes,

Credit Notes,

Debit Invoice,

Credit Invoice,

Proforma Invoice,

Loco Invoice,

Important Questions of UP Board,

Important Questions of Invoice,

Important Questions of Board exam,

Educational Tips for Exam,

Bijak Kya hota h,

Bijak k kitne prakar hote h,

Invoice No Generating using Php Mysql

phpinvoicephpprojectphp

Invoice No Generating using Php Mysqli

Source Code : http://www.tutussfunny.com/invoicenogeneratingusingphpmysql/

More Projects

Jsp Servlet Sales Project Step by Step

https://youtu.be/QxlPKqwAJf0

Registation form Jsp mysql

https://youtu.be/6QbspofYDI

Small Jsp Calculator

https://youtu.be/C3ADw4oTtk0

How to use Session in Jsp

https://youtu.be/oViesie1M0Y

How to use Session in Servlet

https://youtu.be/aM5e88ltQGw

Sales Registation using Jsp

https://youtu.be/rGKmoxchEh0

JSP Login Validation step by step

https://youtu.be/wsswyc1RhhM

Simple Registration Form using Servlet

https://youtu.be/h5mGupPObA

Simple Servlet Mysql Project Step by Step

https://youtu.be/MN2hhYCbx9M

Servlet Jsp Registation form

https://youtu.be/8QlFKhhqDkI

Simple Banking Project Servlet and Mysql

https://youtu.be/PZ7LyeBrvOw

Login using Servlet Jsp Ajax with Session

https://youtu.be/YGYw92hk_w0

Simple Ecommerce Project Using Servlet

https://youtu.be/4XVjTmBmU64

Jsp Ajax Project Step by Step

https://www.youtube.com/watch?v=l9N0pDyi5sk\u0026list=PLuji25yj7oIIeArYREso6z8heYRrqkntb

Learn Jsp Student Management System

https://www.youtube.com/watch?v=6fPCZnU4kzM\u0026list=PLuji25yj7oII0I8xI4_Pp3EoE7NQ6eTLX

Automatically generate the next number when Worksheet on Open in Excel

Increment the number on a worksheet when open. Use a simple macro to increase the number with every open.

Invoice numbers, P.O. numbers will increase so that a new number is generated every time the workbook is open

code

Private Sub WorkbooK_Open()

Range(“B8”).value = Range(“B8”).value+1

End sub

For more help visit my website http://www.easyexcelanswers.com or email me at [email protected].

Contact me regarding customizing this template for your needs.

Click for online Excel Consulting http://www.calendly.com/easyexcelanswers

I am able to provide online help on your computer at a reasonable rate.

https://www.amazon.com/shop/barbhenderson

Check out my next onehour Excel Webinar

https://www.crowdcast.io/easyexcelanswers

I use a Blue condensor Microphone to record my videos, here is the link

https://amzn.to/37gyyGa

Check out Crowdcast for creating your webinars

https://app.linkmink.com/a/crowdcast/83

If you need to buy Office 2019 follow

https://amzn.to/2VX5dv8

I use Tube Buddy to help promote my videos

Check them out

https://www.Tubebuddy.com/easyexcelanswers

Follow me on Facebook

https://www.facebook.com/easyexcel.answers

TWEET THIS VIDEO https://youtu.be/AcUcJw2lrLY

Follow me on twitter

easyexcelanswers

IG @barbhendersonconsulting

You can help and generate a translation to you own language

http://www.youtube.com/timedtext_cs_panel?c=UCFH2kZykqtVX5W9waJzYvQ\u0026tab=2

this description may contain affiliate links. When you click them, I may receive a small commission at no extra cost to you. I only recommend products and services that I’ve used or have experience with.

นอกจากการดูบทความนี้แล้ว คุณยังสามารถดูข้อมูลที่เป็นประโยชน์อื่นๆ อีกมากมายที่เราให้ไว้ที่นี่: ดูวิธีอื่นๆLEARN TO MAKE A WEBSITE

ขอบคุณที่รับชมกระทู้ครับ invoice no