k bank sme: นี่คือโพสต์ที่เกี่ยวข้องกับหัวข้อนี้

What 100,000 bank accounts tell us about French SMEs in September 2021

Anne Epaulard, Etienne Fize, Titouan Le Calvé, Philippe Martin, Hélène Paris, Kevin Parra Ramirez, David Sraer

Governments around the world announced fiscal support measures to keep businesses afloat in response to the Covid-19 shock. This column uses bank account data from 100,000 French firms to examine the solvency and liquidity of companies across sectors. Firms in the accommodation and food services sector are doing surprising well, while many firms in the construction sector are struggling financially. The findings suggests fiscal support may not have worked as intended, and that policymakers should continue to monitor bankruptcies closely in the coming months.

The Covid-19 crisis was characterised in most industrialised countries by an unprecedented drop in economic activity for many firms as well as exceptional government financial aid programmes to help these firms. Fears that a large number of businesses, especially small ones, would fail were prevalent, especially in the first phase of the crisis. This fear motivated researchers to estimate the impact of the Covid-19 shock on firms’ cash flows (taking into account government support). An example of this is the paper by Gourinchas et al. (2021), who construct a model of firm cost minimisation with rich firm-level financial data. They estimate the impact of the crisis on business failures among small and medium-sized enterprises (SMEs). Their simulations suggest that many SMEs would have failed in the absence of policy support. This is also the conclusion of Barnes et al. (2021) in the British case. For France, Coeuré (2021) offers a very detailed firm-level analysis of public support.

Having avoided a massive wave of firm failures during the crisis, today many countries are at a key juncture as the activity of firms – especially those mostly hit by restrictions – is quickly rebounding at the same time as the policy support to these firms is reduced or eliminated. A key question – symmetric to the early concern that public support may not be enough to counter the economic shock to SMEs – is whether the rebound in economic activity will be enough to compensate the reduction in public support. The policy discussion is also complicated by limited real-time information on the financial situation of firms. Existing analysis is based either on simulations (in addition to papers cited above, see Bureau et al. 2021) or on precise but dated (i.e. December 2020) balance sheets information of firms (Doucinet et al. 2021). This lack of real-time information makes it difficult to predict whether and how quickly firm failures will rebound in the near future, an issue which has key consequences for the labour market dynamics or banks losses.

One source of real time data on the financial situation of firms is bank account data. This source has barely been exploited.1 An exception is the Bank of England (Hurley et al. 2021), but the latest data point for which is December 2020.

In a new paper (Epaulard et al. 2021), we exploit a unique data et on corporate accounts of a major French Bank – Crédit Mutuel Alliance Fédérale – to study the evolution of the financial position of French micro-enterprises (MEs) (firms with fewer than ten employees) and SMEs (between 10 and 250 employees). We use a sample of approximately 100,000 anonymised MEs/SMEs throughout the Covid-19 crisis. Specifically, our data track inflows and outflows into checking and savings account, as well as balances on these accounts, and liabilities at the bank. While the dataset does not have any information on non-financial assets and liabilities, it still allows us to track, in near real time and at high frequency, firms’ liquidity and net financial position. Hence, we focus on two dimensions of the financial situation of firms that are known to be good predictors of their risk of failure: liquidity and solvency.

In the future, as the government progressively withdraws its support to firms, monthly updates will allow us to monitor (1) whether the economic recovery is sufficient to offset the drop in financial aid, and (2) whether firms can repay the debt contracted during the crisis. The latest data point we present here is September 2021.

Table of Contents

More cash in all sectors

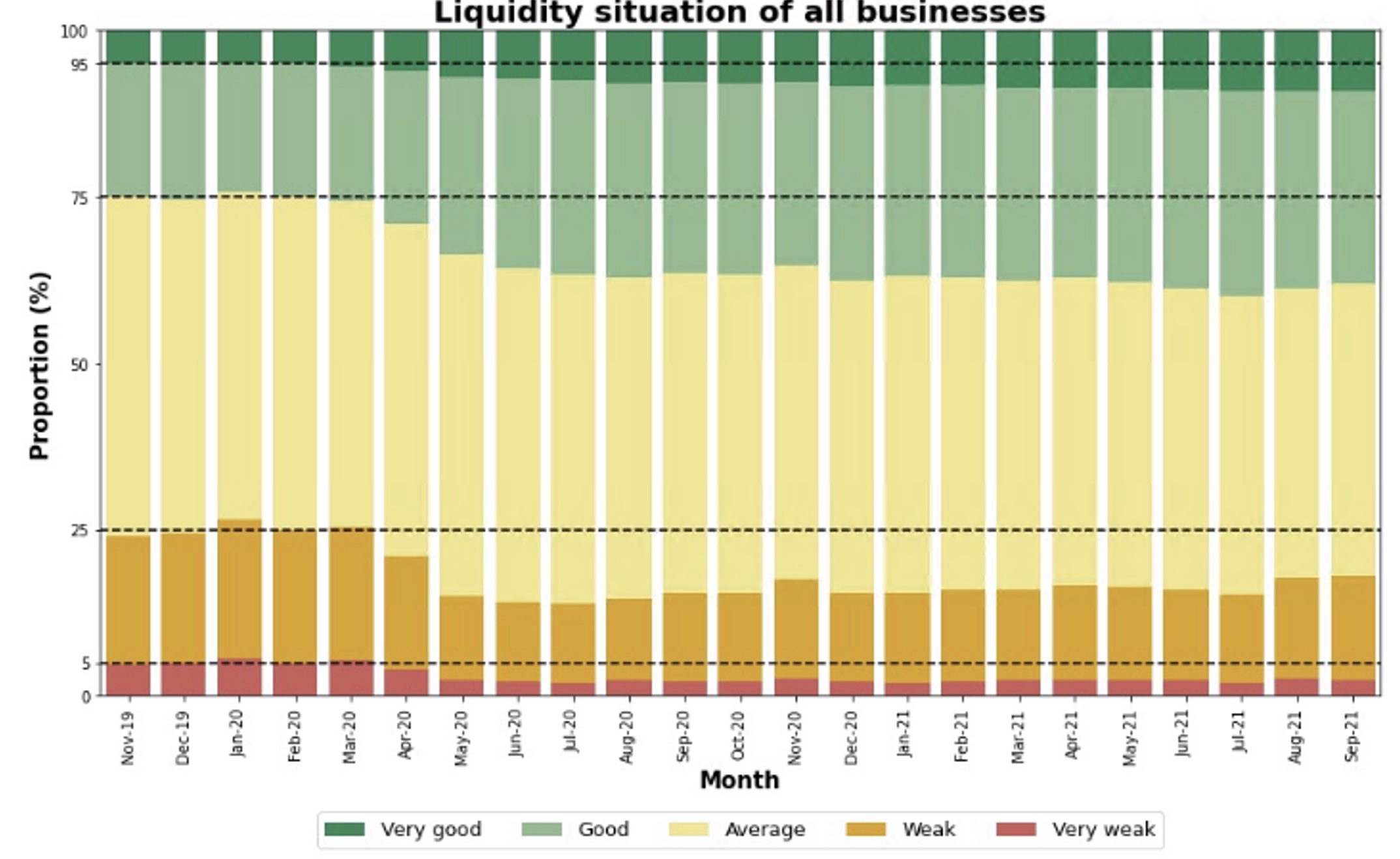

The first striking observation is a significant increase, at the aggregate level, of cash balances held on corporate accounts. This can be attributed to financial support provided by the government, in part through state-guaranteed loans (known as ‘PGE’ in French), which were heavily used by firms in France. All sectors experience an improvement in liquidity, as illustrated in Figure 1. There are fewer companies in August 2021 in a ‘very weak’ or ‘weak’ liquidity position (defined as the share of firms below the 5th and 25th percentile of pre-crisis cash balances) than in the four months preceding the pandemic.

Figure 1 Liquidity situation of all businesses

Note: The dark red part (“Very weak”) corresponds to the share of firms whose liquidity situation at the end of the month is below the threshold that corresponded to the worst 5% of firms before the crisis. The other thresholds are the 25%, 75% and 95% thresholds. The thresholds are calculated within each type of company (SME or ME) as well as within companies in the same turnover bracket.

Source: Crédit Mutuel Alliance Fédérale data.

Net financial position: More heterogeneous situations in September 2021

Beyond liquidity, we also investigate firms’ insolvency risk through their net debt. Net debt corresponds to the difference between the remaining principal balance on all debts held at the bank and the balance on checking and saving accounts. The former includes term loans and short-term debts, including state-guaranteed loans.

For both the average and median firm in our sample, net debt of MEs and SMEs decreased significantly between February 2020 (just before the first lockdown) and September 2021. But this improvement in firms’ financial position was not uniform. Econometric analysis suggests that although the average net debt was reduced over the period, the evolution was less favourable for SMEs than for MEs. This is likely due to the design of the main cash subsidy (Fonds de Solidarité), which was initially more generous for smaller firms. The financial situation has also evolved less favourably in the Paris region. This confirms that in regions where a large share of economic activity relies on tourism, the economic shock triggered by the pandemic was stronger. Our analyses also show that in all geographic areas micro-enterprises in so-called ‘S1 industries’ (i.e. industries classified by the government as the most affected by health restrictions and therefore more subsidised) have experienced a larger reduction in net debt. The fact that the financial situation of small firms in sectors most affected by sanitary restrictions but also most supported by public policy improved more (apart from the Paris region) than firms in less affected sectors suggests that public support may have overcompensated the Covid-19 shock for many firms.

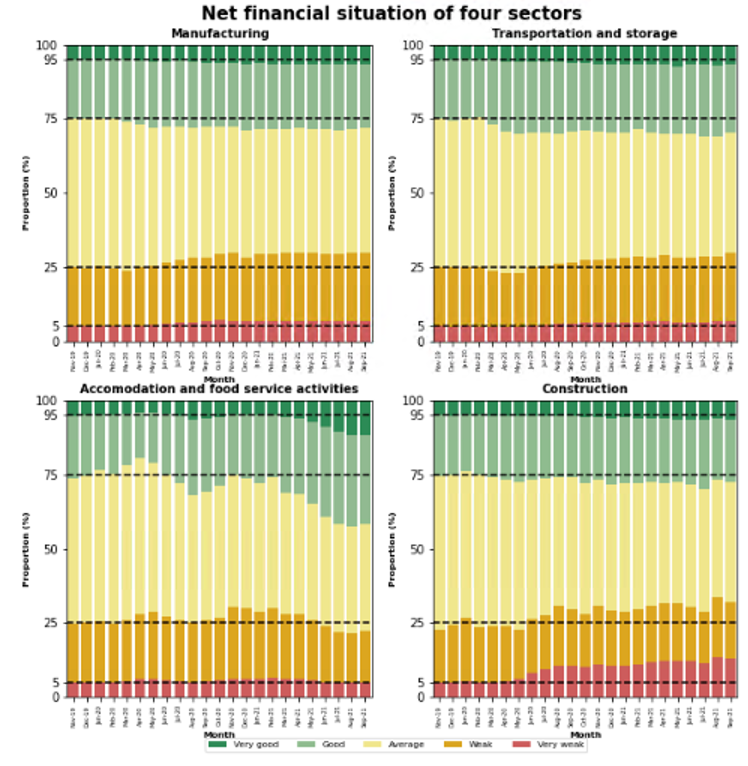

Within each sector there is an increase in heterogeneity of financial situations

Within each industry, there is an increase in the heterogeneity of net financial positions in September 2021 relative to the pre-pandemic situation. In almost all industries, we see an increase not only in the share of firms in a difficult financial situation, but also in the share of those in a strong financial position. The crisis has generated a more polarised distribution of firms within each sector, which may in the future lead to reallocation dynamics with potentially important consequences for the structure of sectors and aggregate productivity. Figure 2 illustrates this increased heterogeneity for the manufacturing, transport, and construction sectors.

Figure 2 Net financial situation of four sectors

Source: Crédit Mutuel Alliance Fédérale data.

There are two notable surprising dynamics. First, the accommodation and food service activities have experienced an overall decrease in the share of firms with ‘weak’ financial positions. Second, the construction sector appears to be the most fragile, with a sharp increase in the share of firms in a ‘very weak’ financial situation. A possible explanation lies in the generous support received by firms in the first sector relative to the second.

What do these results tell us about bankruptcies in the months to come? The number of bankruptcies fell dramatically in 2020 relative to pre-pandemic levels (by around 38% compared with 2019). This drop implies that a number of businesses that have survived in 2020 and 2021 would probably have failed in ‘normal’ times, although firm bankruptcies have responded to the same factors during the crisis as they usually do ( Cros et al. 2021). These firms likely belong to the category of firms we describe as having a ‘weak’ financial position. In several sectors (notably accommodation and food), an increase in bankruptcies in the coming months would thus mostly be a ‘catch-up’ process. But in other industries (notably construction and manufacturing), the rise in the number of firms in a ‘very weak’ financial position is larger than the ‘missing bankruptcies’. In these industries, the question whether weak firms will be able to repay their debt is still open. This calls for vigilance and close monitoring in the coming months. We believe the use of real-time bank data will be particularly useful.

References

Barnes, S, R Hillman, G Wharf and D MacDonald (2021), “How businesses are surviving Covid-19: The resilience of firms and the role of government support”, VoxEU.org, 16 July.

Bounie, D, Y Camara, É Fize, J Galbraith, C Landais, C Lavest, T Pazem and B Savatier (2020), “Consumption Dynamics in the COVID Crisis: Real Time Insights from French Transaction & Bank Data”, CAE focus, October.

Bureau, B, A Duquerroy, J Giorgi, M Lé, S Scott and F Vinas (2021), “Health crisis: (very) heterogeneous cash flow shocks”, Banque de France.

Coeuré, B (2021), “What 3.5 million French firms can tell us about the efficiency of Covid-19 support measures”, VoxEU.org, 8 September.

Doucinet, V, D Ly and G Torre (2021), “The differentiated impact of the crisis on companies’ financial situation”, Banque de France.

Epaulard, A, É Fize, T Le Calvé, P Martin, H Paris, K Parra Ramirez and D Sraer (2021), “The financial situation of French small firms based on their bank accounts in August 2021”, Focus Conseil d’Analyse Economique.

Gourinchas, P O, Ş Kalemli-Özcan, V Penciakova and N Sander (2021), “COVID-19 and SME Failures”, May.

Hurley, J, S Karmakar, E Markoska, E Walczak and D Walker (2021), “Impacts of the Covid‐19 Crisis: Evidence from 2 Million UK SMEs”, Bank of England, Staff Working Paper 924.

Endnotes

1 This is not the case for households’ financial situation during the crisis, as bank accounts have been analysed by several studies (e.g. Bounie et al. 2020).

[NEW] Access to finance for SMEs | k bank sme – NATAVIGUIDES

Europe’s 25 million small and medium-sized enterprises (SMEs) are our focus. They represent over 99% of businesses in the EU. They employ two out of every three employees, create 85% of all new jobs and generate about three-fifth of the EU value-added. Tailor-made support to help them grow and innovate is essential. At all stages of development, small businesses struggle more than large enterprises to get finance. To stay competitive, both start-ups and scale-ups rely on external finance for innovation, digitalisation, internationalisation and upskilling.

Coronavirus response in relation to financing for businesses

We have been mobilising financial support for SMEs through the COSME programme. In particular, we’ve boosted the existing ‘Loan Guarantee Facility’ (LGF) under the programme with additional resources from the European Fund for Strategic Investments to enable banks to offer bridge financing for SMEs. This includes long-term working capital loans (of 12 months or more), as well as credit holidays allowing for delayed repayments of existing loans.

To participate, financial intermediaries had to apply via the European Investment Fund by the end of 2020. Financial intermediaries participating in this programme can provide new financing to SMEs under favourable conditions and simplified eligibility criteria until 31 December 2021. SMEs in search of finance have the opportunity to apply for the working capital facilities directly from the participating financial intermediaries. More information and the names of the institutions are available on the access to finance website.

By 31 March 2021, more than 100,000 SMEs already received €7.7 billion of financing under the COSME LGF-Covid 19 measures.

Additionally, EU countries, national promotional and commercial banks have been putting measures in place for adversely affected SMEs. They focus on facilitating financing, in particular working capital, and flexibility on repayments of existing loans.

Lastly, The European Scale-up Action for Risk capital (ESCALAR) programme supports venture capital and growth financing to help promising companies scale up.

• ESCALAR programme call for expression of interest for financial intermediaries and FAQ document

• Press release, ‘Commission and EIF unlock €8 billion in finance for 100,000 SMEs‘

• Press release, ‘ESCALAR: up to €1.2 billion to help high potential companies grow and expand in Europe‘

• The COSME programme for the competitiveness of SMEs and the Loan Guarantee Facility

• Access to finance website

Financing your business

EU financing programmes are generally not provided as direct funding. We channel support through local, regional, or national authorities, or financial intermediaries such as banks and venture capital organisations that provide funding with financial instruments.

Visit the EU access to finance portal to find intermediaries.

See the introduction video on the EU access to finance.

EU financial instruments are risk-sharing schemes. Examples are guarantees to financial intermediaries who provide lending, lease finance, or co-investments with venture capital funds, backed by EU funds. Reputable financial intermediaries such as banks, lessors, mutual guarantee societies, microfinance providers and venture capital funds provide the final support. They are closer to the final beneficiaries and qualified to assess their needs and risks. Decisions to provide loans, guarantees, or venture capital are made by the local financial institutions. The exact financing conditions (such as the amount, duration, interest rate, and fees) depend on the financial institution.

EU financial instruments are market-driven, there are no country allocations and the availability of funding depends on the interest of local financial institutions taking part in the scheme. The financial intermediaries create individual products suited to the needs of SMEs in their market.

Policy areas

We use financial instruments and helps EU countries share good practice in the following policy areas

Forum of national financing experts of the SME Envoys Network

The SME envoys network’s forum of national financing experts regularly analyses and discusses issues and solutions around improving access to finance for small businesses.

In 2021 we conducted a survey with the SME envoys network to help address the solvency risk affecting SMEs during and after the COVID-19 pandemic. As announced in the Industrial Strategy, we held a roundtable with national financial experts nominated by the SME envoys network at the end of September 2021. It addressed the exchange of good practices on national measures to aid recapitalisation, debt conversion, and SME balance sheet strengthening.

Data and surveys – SAFE

The joint European Commission/European Central Bank survey on the access to finance of enterprises (SAFE) monitors developments in access to finance for small businesses.

Data and surveys – SAFE

Main EU initiatives

60FPS | 4K UHD⁺ BLACKPINK x OLENS CF (FULL ver.)

60FPS | 4K UHD⁺ BLACKPINK x OLENS CF (FULL ver.)

Check out the original MV here: https://youtu.be/Hc02qRS7_c

•This is solely for entertainment purposes ONLY! For you to enjoy smoother videos at 60FPS!

•There will be inevitable bugs throughout the video because of the rendering process.

‹ No copyright infringement intended.

‹ This song does not belong to me.

‹ I do NOT earn any money from this video !!!

All rights belong to rightful owner.

THUMBS UP if you like this video \u0026 SUBSCRIBE for more 60FPS KPop music videos

TAGS:

kpop 60fps,kpop 60fps 4k,60fps,4k video,4k,blackpink olens,오렌즈,OLENS,블랙핑크,BLACKPINK,블핑렌즈,렌즈추천,비비링,스페니쉬,심포니,blackpink olens 2019,blackpink olens cf,blackpink olens lisa,blackpink olens jennie,blackpink olens commercial,blackpink olens commercial 2019,blackpink olens new commercial,blackpink olens fansign jisoo,blackpink olens ad,blackpink commercial,blackpink commercial 2019,blackpink commercial reaction,blackpink commercial olens

นอกจากการดูบทความนี้แล้ว คุณยังสามารถดูข้อมูลที่เป็นประโยชน์อื่นๆ อีกมากมายที่เราให้ไว้ที่นี่: ดูเพิ่มเติม

BLACKPINK X PEPSI COMMERCIAL FULL VERSION

BLACKPINK PEPSI

blackpinkofficial IG update

: https://www.instagram.com/p/CHH2kCtD2Dq/?igshid=5beylrqpieiv

Go all in for what you love

SME CHAMPION l KTB-KBank-SCB ศึก Platform Digital ดึงลูกค้าใหม่

SME CHAMPION l KTBKBankSCB ศึก Platform Digital ดึงลูกค้าใหม่

จากการเปลี่ยนแปลงของกลุ่มผู้ให้บริการด้านธนาคารในประเทศไทย ที่ได้รับผลจากการที่เทคโนโลยีเข้ามามีบทบาทจนทำให้ธนาคารต่างๆ ต้องเร่งปรับตัวตาม

FinTech ถูกพัฒนาเพื่อมาปรากฎบนสื่อสมาร์ทโฟนของผู้ใช้บริการมากขึ้น ซึ่งเราจะเห็นได้ว่า ประชาชนส่วนใหญ่จะใช้งานต่างๆ บนสมาร์ทโฟน ดังนั้น การที่ธนาคารปรับเปลี่ยนรูปแบบเพื่อให้ตอบสนองและใกล้ชิดกับผู้ใช้บริการ จึงเป็นสิ่งที่เร่งพัฒนากันอย่างต่อเนื่อง

สำหรับ Platform Digital ของกลุ่มธนาคารรายใหญ่ เช่น ธนาคารกรุงไทย (KTB), ธนาคารกสิกรไทย (KBank) เร่งพัฒนาการให้บริการครอบคลุมนอกเหนือจากการฝากถอนโอนจ่ายเพียงอย่างเดียว ทั้งนี้ เราจะเห็นได้ว่า หลายๆ ธนาคารใช้เทคนิคการให้แต้ม (Point) สะสมแต้มเพื่อแลกและเป็นส่วนลดบริการต่างๆ

ดังนั้น สรุปได้ว่า การที่กลุ่มธนาคารยักษ์ใหญ่เร่งพัฒนา Platform เป็นเพราะจะต้องหากลุ่มตลาดใหม่เพื่อสร้างฐานผู้ใช้งานในอนาคต ซึ่งกลุ่มเป้าหมายต่อไป คือ กลุ่มผู้ที่มีอายุตั้งแต่ 15 ปีขึ้นไป เช่น กลุ่มนักเรียน ม.4 หรือ ปวช. ที่ต้องเปิดใช้งานสำหรับการกู้ กยศ. หรืออาจจะเป็นกลุ่มนักศึกษาที่เข้าเรียนในมหาวิทยาลัย ซึ่งจะต้องเปิดบัญชีพร้อมกับการทำบัตรนักศึกษา นับว่าเป็นบริการพ่วงที่เกิดขึ้นในทุกมหาวิทยาลัย นอกจากนี้ สิ่งที่ธนาคารต่างๆ วางกลยุทธ์ไว้ คือ การเป็น Universal ทางด้านธนาคาร ซึ่งให้บริการมากกว่าฝากถอนโอนจ่าย

วิเคราะห์เรื่องราวทั้งหมด โดย ดร.อุดมธิปก ไพรเกษตร กรรมการผู้จัดการบริษัท ดิจิทัล บิสิเนสคอนซัลท์ จำกัด และรองประธานสมาพันธ์เอสเอ็มอีไทย และ ปิยะพงษ์ เคนทวาย

ติดตามรับฟังบทวิเคราะห์ได้ในรายการ SME Champion 14.0014.30 ทางสถานีวิทยุกระจายเสียงมหาวิทยาลัยเทคโนโลยีราชมงคลธัญบุรี FM 89.5 Mhz

[ 22 กุมภาพันธ์ 2562]

SME_Champion, วิทยุราชมงคลธัญบุรี, SME, เอสเอ็มอี,

สินเชื่อ SME Kasikorn Bank Group

TO THE MOON – hooligan. (Official Lyric Video)

tothemoon hooligan SMEVN DreaminHood GALabels

🎧 Stream audio TO THE MOON on https://sonymusicvietnam.lnk.to/tothemoon

TO THE MOON Một sản phẩm của hooligan.

“To the moon” is a song about “Unrequited love”. This love does not die; it only grows stronger with the distance. Yet it gets suppressed to a secret place where it burns and causes suffocation. So the guy resisted showing her his love, knowing that too much truth can ruin.”

Produced by Dreamin’hood

Arrangement: Jimi

Singer And Composer: hooligan.

Lyrics: Sean Doan

Sound Recording: 90 Kroove Studio

Video Editor: MOV Production Team

Designer: Thành Cao Pusaac

Special thanks to Sony Music Entertainment Hong Kong Ltd, Star Academy of Arts, Hong Ngoc and Julie.

Made with the support of GA Labels.

Follow hooligan. online:

► Facebook: https://www.facebook.com/hooligan.crazy

► Instagram: https://www.instagram.com/hooligan.inthedark/

► Tiktok: https://vt.tiktok.com/SqreLP/

Bên cấp phép cho YouTube:

SME (thay mặt cho Sony Music Entertainment)

นอกจากการดูบทความนี้แล้ว คุณยังสามารถดูข้อมูลที่เป็นประโยชน์อื่นๆ อีกมากมายที่เราให้ไว้ที่นี่: ดูบทความเพิ่มเติมในหมวดหมู่LEARN TO MAKE A WEBSITE

ขอบคุณมากสำหรับการดูหัวข้อโพสต์ k bank sme